Frequently Asked Questions (FAQ's)

Who gets a late fee?

Any student who arranges payment after the term's billing due date is subject to a late fee.

Can I get my late fee waived?

It is possible to get a late fee waived as a one-time exception, based on the reason for late payment (case-by-case basis).

How do I dispute a charge?

To dispute a charge, please contact the Student Accounts Office via email at studentaccounts@framingham.edu with details of the charge you are disputing. Please note - not all charges are generated from the Student Accounts Office.

How do I dispute a parking permit charge?

If you are disputing a parking charge, please contact Campus Police at parking@framingham.edu.

How do I dispute a housing charge or dorm damage fee?

If you are disputing a housing charge or dorm damage fee, please contact Residence Life at residencelife@framingham.edu.

How do I submit an outside scholarship?

If you have been awarded an outside scholarship and it is addressed to Framingham State University, please submit your award letter for this scholarship that lists the organization, term, and amount. Once we receive your scholarship letter, we will put a temporary credit onto your account.

Why isn't my financial aid showing on my account?

If your financial aid is not showing on your account, it could be caused by one of two things:

1. You have not registered for the amount of courses you reported on your FAFSA. If you are listed as a full-time student on your FAFSA or award letter, but did not register for enough courses, your aid may not show on your account.

2. You may owe the Financial Aid Office additional verification paperwork, or you may need to complete Entrance Counseling and a Master Promissory Note (MPN) for your federal loans. Please contact the Financial Aid Office at financialaid@framingham.edu so they can check your status.

What does “tuition freeze” mean?

A tuition freeze means that the rates of tuition and fees will not change from one year to the next. Students are still responsible for tuition and fees at the current rate according to their registration.

How do I apply my Veteran Tuition Waiver to my account?

You will need to complete a Veteran Tuition Waiver and turn it in to the Veteran Services Office (veterans@framingham.edu). If you are eligible, your waiver will cover the tuition portion of your bill.

Is there a way to get my financial aid refund early?

If you are experiencing unexpected hardship, please complete the Emergency Advance Request Form. Our office will review your request to see if you are eligible to get part of your refund earlier than the designated refund date.

How do I enroll in a payment plan?

To enroll in a payment plan, go to the e-pay portal on your myFramingham account, then select the "Payment Plans" button at the top. This will bring you to the page where you can enroll in FSU's payment plan.

When is the payment plan available?

Fall Payment Plan Schedule:

5-month plan: July 1st - November 1st

4-month plan: August 1st - November 1st

Spring Payment Plan Schedule:

5-month plan: December 1st - April 1st

4-month plan: January 1st - April 1st

Summer Payment Plan Schedule:

3-month plan: May 1st - July 1st

*Please note: You can only sign up for the 4-month plan if the 1st payment of the term has passed. All others must sign up for the 5-month plan*

How do I cancel my payment plan?

Please call or email the Student Accounts Office at 508-626-4514 or studentaccounts@framingham.edu if you wish to cancel your payment plan.

What happens if I don’t make a scheduled monthly payment on time?

Any delinquent payments with the payment plan will result in a $10 late fee.

How can I change my budget?

The budget cannot be changed manually as it is equal to the amount due for the term. Payment plan budgets will change automatically based on any change in your charges or credits on your account.

Can I include my prior term balances to the payment plan?

Payment plans can only be used for the current term. Past due balances must be paid in full.

Why did my budget change?

Payment plan budgets automatically update based on any changes – including charges, payments, financial aid, etc. This information is included on the enrollment form and notifications are sent to the payer when budgets are changed.

Can I have two payment plans set up for the semester?

No. Only one payment plan is permitted per term.

How will monthly payments reflect on my account?

Payments will be itemized on your account with the method of payment you used – For example, the payment would be displayed as “Payment Gateway Visa” if your payment was made online with a Visa account.

What is a Student Financial Responsibilities Agreement (SFRA) and why do I need to agree to it?

A Student Financial Responsibilities Agreement is a contract between you and Framingham State University, which outlines your financial obligation when you register for courses at FSU. When you enroll in a course at FSU, you are receiving an educational service in which you are required to pay for. When agreeing to the SFRA, you are authorizing the University to charge any tuition, fees, costs, interest or other charges to your student account, as a result of your registration/enrollment.

If you decide to drop or withdraw from a course after the course has already begun, you are obligated to pay for the course.

When do I need to sign the SFRA?

In order to comply with the University’s financial terms and conditions, you will need to sign an SFRA each term you attend FSU. This includes Fall, Winter, Summer, and Spring terms.

What happens if I do not sign the SFRA?

If you do not sign the SFRA, or you decide to decline the agreement, you will not be able to register for courses. If you decline the agreement, you will be able to go back and agree to the terms and conditions later, if you so choose.

How do I sign the SFRA?

- Log into your myframingham account

- Click on menu in the top left corner

- Click on ‘Students’

- Click on ‘Advising and Registration’ from the drop down menu

- Select ‘Course Search and Registration’ or ‘Add/Drop Course’

- Click on the Menu Icon in the top left corner

- Click on the Banner drop down menu

- Click on the Student drop down menu

- Click on ‘List of Action Items’ to view the Student Financial Responsibilities Agreement (SFRA)

- Click on the hyperlink to view the agreement

- A pop up will appear - click ‘Continue’

- Click ‘Accept Terms and Register’ box

- Click ‘Save’

Have the withdrawal policies changed?

No, the FSU’s withdrawal policies have not changed.

How often do I need to sign the SFRA?

You will need to sign the agreement each term you attend FSU. [Fall, Winter, Spring, Summer]

My parents pay my bill, do they need to sign the SFRA?

No, you will need to sign the SFRA since you are the one taking courses at FSU. Even if your parent or family member helps you pay your bill each term, you are responsible for any unpaid balances at the University.

If I have financial aid or scholarships covering my bill, do I still need to sign?

Yes, even if you have financial aid or scholarships covering your bill, you still need to sign the agreement. If you become ineligible for your financial aid/scholarships, you are responsible for the balance due.

Can I give my refund back to the school and reduce my loans instead?

Students are allowed to return their refund checks to the Students Accounts Office if they wish to reduce their loans with Financial Aid. However, this needs to be done within two weeks of the disbursement of your loan. Please note - all returned refund checks need to be returned with a signature on the back and you must arrange for your loans to be reduced with Financial Aid first. For further information, please contact the Financial Aid Office at financialaid@framingham.edu. If you miss this timeframe, you can apply your refund directly to your outstanding loans through your loan servicer at any time.

What is an Emergency Advance?

Refunds are processed for students who have a credit from excess financial aid or overpayments on their account. An Emergency Advance is a refund that is sent to you before your financial aid comes in officially. Loans and grants are usually refunded a week or two after they have officially reached the University. When you request an Emergency Advance, you are requesting that the University sends you part of your refund before the funds come in to the University. (Emergencies Only)

How do I get an Emergency Advance refund?

If you have excess financial aid on your student account and are in need of an emergency refund before the funds have been disbursed to the University, please complete an Emergency Advance Form and submit it to the Student Accounts Office. Emergency Advance funds are not guaranteed, and are approved on a case-by-case basis.

I don't want a refund check in the mail. How do I set up an e-refund account?

To set up an e-refund account, log into your myFramingham account. Once you're on myFramingham, go to the Finances page, then select View Detailed Bill. Once you're on the e-pay portal, select Electronic Refunds on the right-hand side of the page and put in the account information for the bank account in which you would like to receive your refund.

Who qualifies for a Book Voucher?

Students with excess financial aid will qualify for a Book Voucher through the University. This will allow students to use their excess aid for books in the University Bookstore.

When are Book Vouchers available?

Book Vouchers are generally available about two weeks before the start of classes and end about two weeks after the start of classes.

What happens if I don't use my Book Voucher?

If you do not use your Book Voucher, the money will be credited back to your student account. If you still have a credit balance at that time, the credit will be refunded to you.

Where can I use my Book Voucher?

You can either use your Book Voucher on the University Bookstore's website or in the Bookstore.

What can the Book Voucher be used for?

Book Vouchers can only be used on books and qualifying materials in the FSU Bookstore.

How much of my excess financial aid can be used as a Book Voucher?

If you have excess financial aid listed on your account, you can use up to $700 of this credit in the Bookstore. To verify, please contact Student Accounts at studentaccounts@framingham.edu. If you are eligible for the Book Voucher, you will be sent an email from the Bookstore.

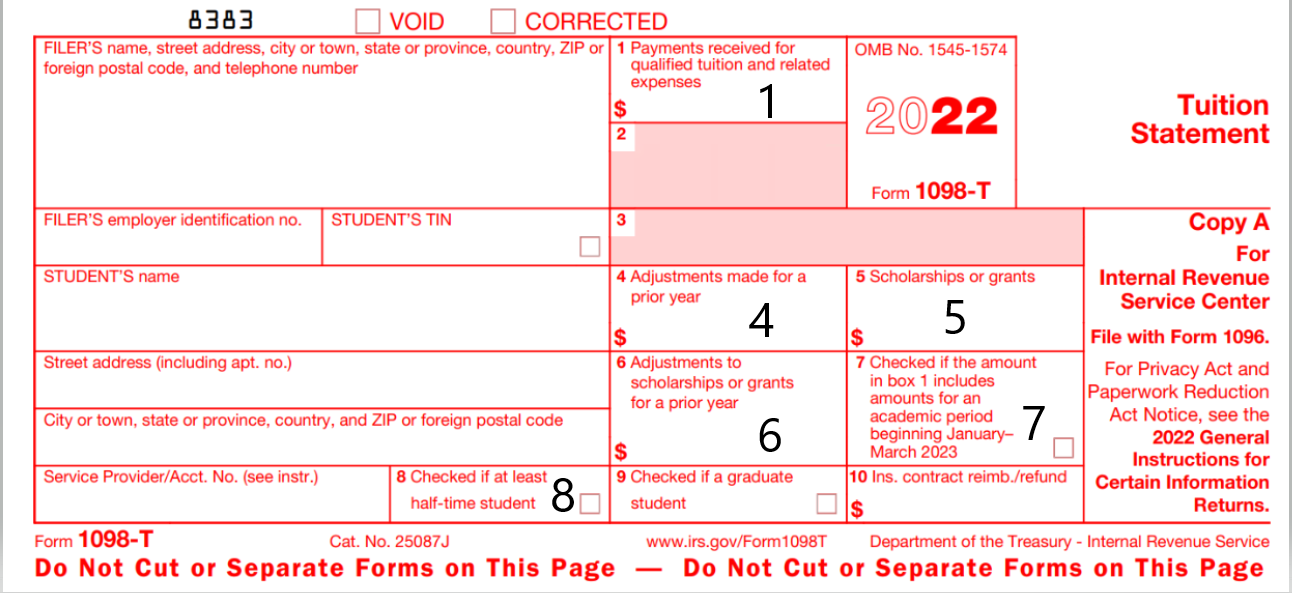

What is a 1098-T Form?

The 1098-T form is an annual informational document that all educational institutions are required to prepare for eligible students. It contains information on qualified tuition and related expenses within the calendar year, January-December. Students are not required to use the 1098-T form but can use the information provided when completing their tax returns. While Framingham State University cannot advise on how you should use the form, your tax professional can.

Where can I find my 1098-T?

You can find your 1098-T on your myFramingham account, under the Finances section, under Tax Notification. Once you click on Tax Notification, select the tax year and you will be able to view or print the document.

You can also find your 1098-T on the ECSI website. Once you have clicked this link and are on the ECSI website, select 1098-T, then type in Framingham State University as your school. Then insert your information on the next page. The tax year would be 2023.

What am I supposed to do with the Form 1098‐T?

Unfortunately, we cannot provide you with tax advice, so we suggest that you contact your accountant or tax advisor if you have specific questions related to your tax requirements and responsibilities. However, we can inform you that you are not required to attach IRS Form 1098‐T to your tax return, but it would be wise to keep it for your records.

When will I receive my 2022 1098T form?

You will be notified by email on or before January 31, 2024 from cservice@ecsi.net when your 2023 1098-T form is ready to be viewed via the Heartland ECSI website.

How do I access my 1098-T

All 1098-T forms for Framingham State University are available through Heartland ECSI. You may access the forms via myFramingham or by visiting ECSI’s website.

What information is reported on the 1098T?

Box 1

Framingham State University reports on qualified payments, as required by the IRS. As such, only payments for qualified charges will be eligible to be reported.

Box 4

Reflects reductions in charges for qualified tuition and related expenses made during this calendar year that relate to amounts billed that were reported in a prior year. This could impact a tax credit for a prior year. Your tax preparer should be consulted.

Box 5

Reflects the total of scholarships and grants that were posted to the tuition account during calendar year 2023. This may also include additional scholarship and grant funds posted late for a prior year.

Box 6

Reflects reductions in scholarships and grants reported for a prior year. This could impact a tax credit for a prior year. Your tax preparer should be consulted.

Box 7

Is checked if there are charges for terms beginning January 2023–March 2023.

Box 8

Is checked if a student is at least half-time during any academic period that began in 2023.

Why did I not receive a 1098-T?

The IRS does not require us to generate a 1098-T for the following:

- Students enrolled in non-degree programs

- Students who did not have qualified tuition and related expenses

- Students whose qualified tuition and related expenses are entirely waived or paid entirely with scholarships

An example of a student that would not be eligible for a 1098-T would be a student taking Professional Development courses.

For additional information, please refer to the IRS 1098-T instructions, here.

What should I do if my 1098-T tax form does not match my personal information?

This was obtained from information provided to Framingham State University. Please contact the University Registrar’s Office at registrarsoffice@framingham.edu if any changes need to be made.

As an international student, will I receive a 1098-T?

A 1098-T was created for all students that have qualified tuition, related expenses and payments and received a SSN/TIN validation communication in the Fall 2023. International students that are filing Federal Income Tax that do not have a SSN/TIN on file will need to complete a Taxpayer Identification Number Request Form and submit to the Registrar’s office by February 20, 2024 and notify student accounts studentaccounts@framingham.edu by February 20, 2024 as well, so your 1098-T can be updated.

Why am I being charged for health insurance?

State law requires all students with a 3/4 course load (3+ courses for undergraduates; 2+ courses for graduates) to have health insurance coverage. Framingham State University will automatically bill students with a 3/4 course load with the annual coverage provided through our third-party partner, University Health Plans. Students must make an election online to waive or enroll in the university health insurance program.

How do I waive the University’s health insurance?

To waive the University’s health insurance, go to the homepage of your myFramingham account, click on Health Insurance Requirement under the Billing Requirements section. On the next page, click on Waive. On the UHP site, click on Waiver Form on the left-hand side of the page. Please be sure to spell your full name, capitalizing the first letters. (Example: John Smith)

How do I enroll in the University’s health insurance?

To enroll in the University’s health insurance, go to the homepage of your myFramingham account, click on Health Insurance Requirement under the Billing Requirements section. On the next page, click on Enroll. On the UHP site, click on Enrollment Form on the left-hand side of the page. Please be sure to spell your full name, capitalizing the first letters. (Example: John Smith)

Why won’t the UHP waiver/enrollment form work for me?

If you are getting an error when trying to complete a waiver/enrollment form, it may be due to your enrollment status or the way you are typing your name. If you are not enrolled full-time (3+ courses for undergraduates; 2+ courses for graduates), you will not be required/able to complete a waiver/enrollment form. If you are typing a nickname or in all lowercase letters, the system may not be identifying your name. Please contact UHP or Student Accounts if errors reoccur.

Can I have the University’s health insurance plan along with the coverage I already have?

Yes, you may enroll in the University’s health plan, even if you already have coverage.

What is the University’s health plan?

Framingham State’s health insurance plan is under Blue Cross Blue Shield.

I completed a health insurance waiver – why isn’t it showing on my account?

If you have completed a waiver recently, please allow 3-5 business days to see your e-bill update. Please contact Student Accounts if you still do not see your waiver after 6 business days.

Why am I not being charged with the University’s health insurance?

If you are not being charged with the University’s health insurance, you are likely registered for less than 3 courses (as an undergraduate), or 2 courses (as a graduate).

Can I waive the insurance if I have MassHealth?

Yes, you can complete the health insurance waiver if you have a qualifying MassHealth health insurance plan.

How much does the University’s health insurance cost?

The University’s health insurance plan is $3,779 for the Annual Plan (August 1, 2023 – July 31, 2024) and $2,206.50 for the Spring-Only plan (January 1, 2024 – July 31, 2024). Please note, the Spring-Only plan is designated for students who are new to FSU in the Spring, newly 3/4 time in the Spring, or have lost their coverage as of January 1, 2024.

Will students receive credit for their room charges if the residence halls need to close during the Spring 2023 semester due to COVID-19?

Yes. Students who are required to leave campus will receive prorated adjustments; if these adjustments result in an overpayment, then the student will receive a refund.

Will students receive a credit for unused money on their meal plans if the residence halls close due to COVID-19?

Yes. Students will receive a prorated adjustment for mandatory meal plans; if these adjustments result in an overpayment, then the student will receive a refund.

If I have a balance due, will I still receive a refund for room and board due to COVID-19 closures?

If the residence halls are closed during the Spring due to COVID-19, students living in residence halls, who move out completely, will receive a prorated adjustment of their room and board costs for the semester. The credit will be applied to any outstanding balance owed to the University first; if the adjustment results in an overpayment on the account, then a refund will be issued.

Will students receive a tuition refund or a reduction of tuition and fees?

We hope the semester will not be disrupted by a shift in learning modes, such as face-to-face or remote learning, due to a resurgence of COVID-19 cases. If a shift is required, tuition and fees for the Spring 2023 semester will be the same, regardless of the method in which the University delivers your academic experience. The tuition and fees that you pay are in exchange for learning, academic credit, and/or certain non-academic services that will be provided to you, regardless of the format in which they're offered.

The University cannot guarantee an on-campus experience, because health and safety concerns related to COVID-19 and its spread on campus, and/or directives from appropriate federal and state health authorities, may require that your academic experience during the Spring 2023 semester be offered through a hybrid model of on-campus and remote experiences or entirely remotely. Any interruption due to COVID-19 that results in change in the way your academic services are being provided, including any suspension of in-person instruction and campus activities, will not entitle you to a reduction or reimbursement of tuition and fees.

What is a Perkins Loan?

The Perkins Loan is a low-interest federal student loan for undergraduate and graduate student with qualifying financial need. The Federal government ended the program on September 30, 2017.

Did I ever borrow a Perkins Loan?

If you have a Perkins Loan, your account is either with UAS (University Accounts Service) or with a collections agency. To check the status of your loan, please contact UAS directly at 844-870-8701 or the Student Accounts Office at studentaccounts@framingham.edu

I received notice that my Perkins Loan was assigned. Who do I pay/contact now?

If your Perkins Loan was recently assigned to the Department of Education, please contact ECSI at 1-888-549-3274 for more information or to make payments towards your loan.

How do I make a payment for my Perkins?

If you would like to make a payment towards your Perkins Loan, please call UAS at 844-870-8701.

Can I get a Perkins Loan now?

Unfortunately, the Perkins Loan Program has been discontinued. Please check with the Financial Aid Office to discuss other options that may be available to you.

What should I do if I'm in default with my Perkins Loan?

If you are currently in default with your Perkins Loan, please contact Student Accounts (studentaccounts@framingham.edu) or UAS (844-870-8701) directly to discuss options.

What is UAS?

UAS, University Accounts Service, is Framingham State's servicer for the Perkins Loan.